What Are Wall Street Analysts' Target Price for Brown & Brown Stock?

/Brown%20%26%20Brown%2C%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $31.8 billion, Brown & Brown, Inc. (BRO) is a leading provider of insurance products and services across the United States, Canada, Ireland, the United Kingdom, and internationally. It operates through four segments: Retail; Programs; Wholesale Brokerage; and Services, offering a wide range of insurance solutions, risk management, and claims administration services to commercial, public, and individual clients.

The insurance company's shares have lagged behind the broader market over the past 52 weeks. BRO stock has decreased 6.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.3%. Moreover, shares of the company are down 5.5% on a YTD basis, compared to SPX’s 8.3% gain.

In addition, shares of the Daytona Beach, Florida-based company have also underperformed the Financial Select Sector SPDR Fund’s (XLF) 20.3% return over the past 52 weeks.

Despite beating estimates with Q2 2025 adjusted EPS of $1.03 and revenue of $1.3 billion on Jul. 28, Brown & Brown’s shares tumbled 10.4% the next day. Investors focused on the 10.1% year-over-year decline in income before income taxes to $311 million and margin compression, as margins dropped sharply to 24.2% from 29.4% in the prior-year quarter.

For the current fiscal year, ending in December 2025, analysts expect BRO’s adjusted EPS to grow 7.6% year-over-year to $4.13. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

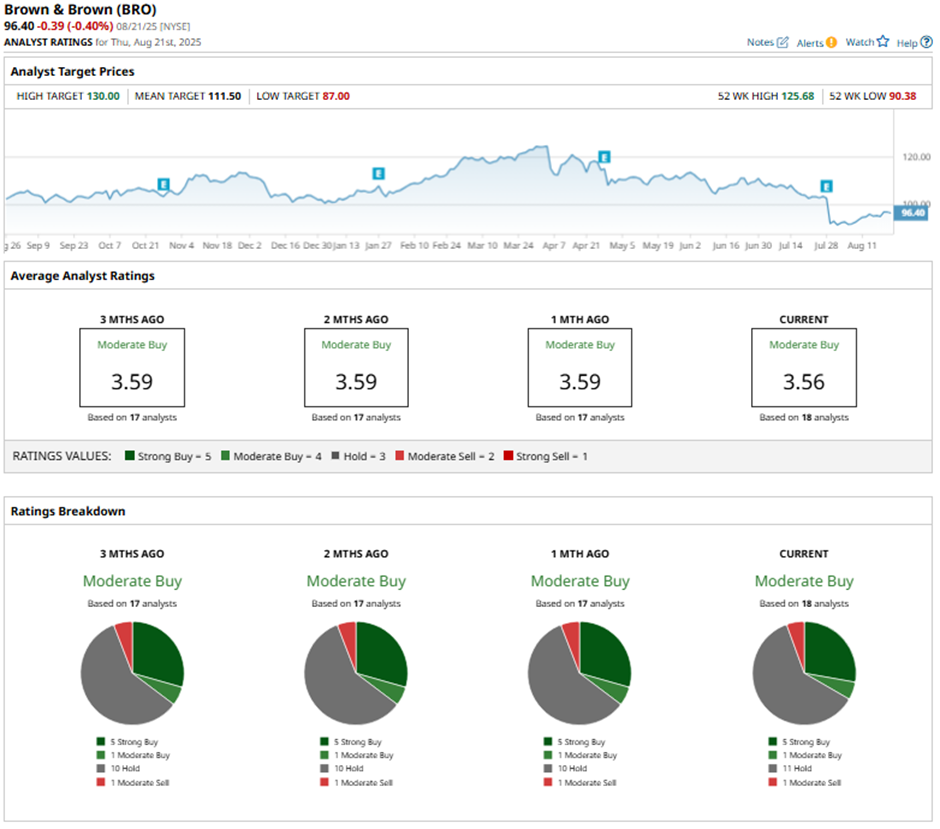

Among the 18 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and one “Moderate Sell.”

On Aug. 18, Morgan Stanley lowered Brown & Brown’s price target to $105 while maintaining an “Equal Weight” rating.

The mean price target of $111.50 represents a 15.7% premium to BRO’s current price levels. The Street-high price target of $130 suggests a 34.9% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.