Is This the Only Tech Stock You Need to Own for the Next Decade?

/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

When you think of must-have tech stocks for the next decade, a few names typically come to mind: Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA). But Amazon (AMZN) may be quietly making the most compelling case of all. The e-commerce and cloud computing giant has experienced explosive growth in recent years, largely due to its dominant position in various business verticals.

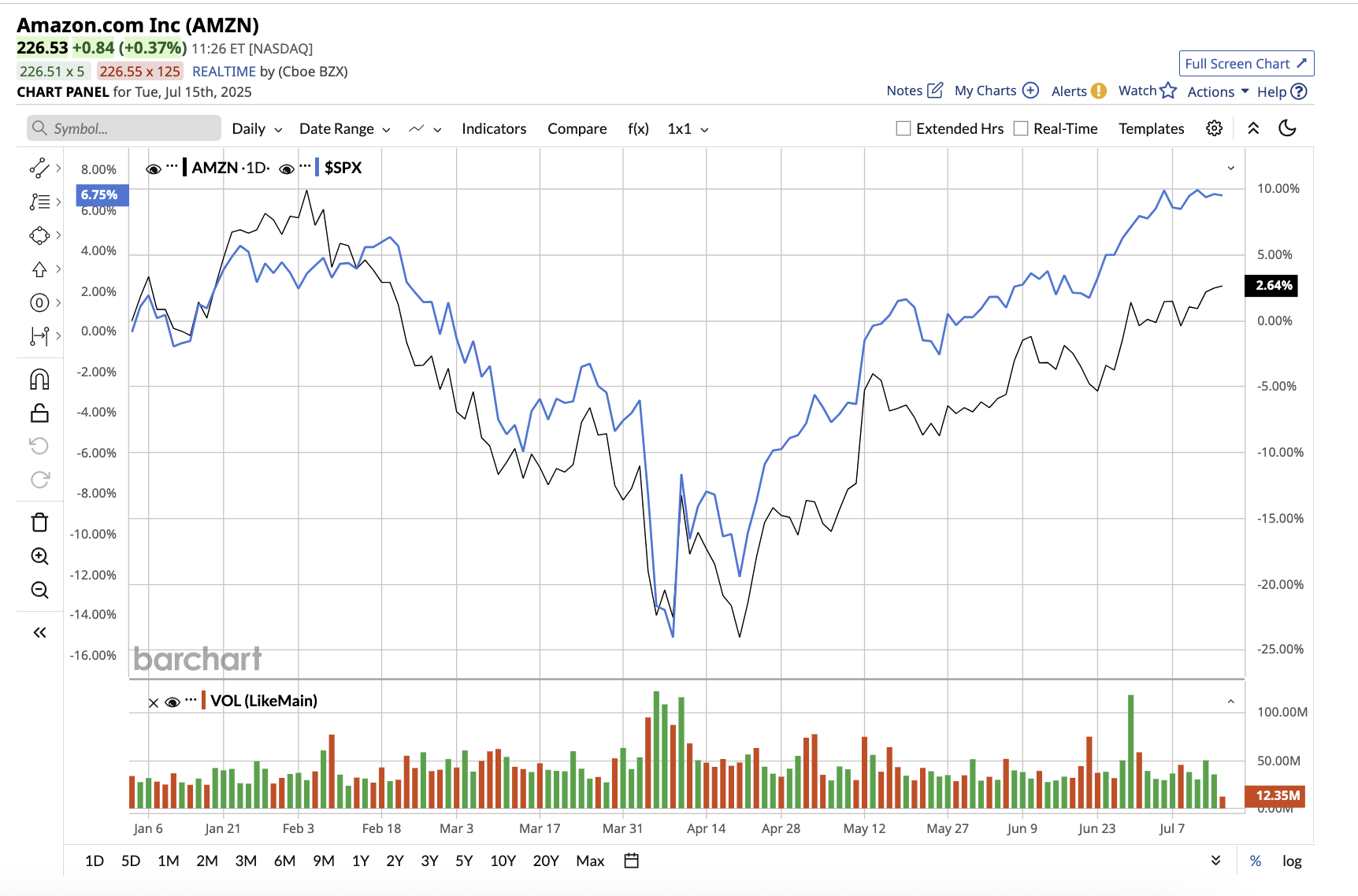

Valued at $2.4 trillion, Amazon stock has returned a staggering 745% over the last decade. In its most recent earnings call, CEO Andy Jassy made it clear that Amazon is aggressively developing the infrastructure, AI capabilities, and consumer loyalty that could make it the only tech stock long-term investors are looking for.

Let’s find out if it is the right time to buy this exceptional growth stock.

Strong Financials Amid Global Volatility

Amazon’s first-quarter revenue came in at a massive $155.7 billion, a 9% increase over the same period last year. Net income for the quarter stood at $17.1 billion, or $1.59 per diluted share, including a $3.3 billion pre-tax gain on its investment in AI startup Anthropic. This represented a 62.2% year-over-year increase. This boost in profitability was not a one-off. Amazon’s profits have been rising over the last few quarters.

Amazon continues to show that it is not only a massive, but also a highly profitable, company, and its diverse business model is firing on all cylinders. Despite being the world’s largest online retailer, Amazon’s core e-commerce business is constantly evolving and outperforming. In Q1, Amazon delivered more items same-day or next-day than in any other quarter in its history. With expansion plans into rural America, the company is doubling down on logistics as a long-term competitive advantage. In North America, revenue increased by 8% to $92.9 billion, while international sales increased by 8% to $33.5 billion.

Regarding tariff concerns, management stated that Amazon’s sheer selection and seller diversity, with over 2 million global sellers and hundreds of millions of unique SKUs, make it remarkably resilient. And its emphasis on essential goods shields it from many volatility-driven demand swings.

Moreover, Amazon’s advertising business is quietly becoming one of its most important revenue generators. In Q1, advertising revenue increased 19% to $13.9 billion, indicating that brands are increasing their investment to reach Amazon’s massive user base directly at the point of purchase. The company now gives brands access to more than 275 million ad-supported audience members in the U.S., leveraging assets such as Prime Video, Twitch, IMDb, and even NFL and NBA broadcasts.

AWS: The Crown Jewel That Keeps Shining

Amazon Web Services (AWS) remains the growth engine, reporting Q1 revenue of $29.3 billion, up 17%. AWS now has an annualized run rate of more than $117 billion, reaffirming its leadership in a market that will continue to grow as generative AI, big data, and cloud migration trends accelerate. CEO Andy Jassy hinted that cloud adoption is still in its early stages, with 85% of IT spending remaining on-premises. AWS’s operating income came in at $11.5 billion, demonstrating that, despite significant investments in AI infrastructure, Amazon’s cloud business remains highly profitable.

AWS has signed agreements with Adobe (ADBE), Uber (UBER), Nasdaq (NDAQ), NextEra Energy (NEE), GE Vernova (GEV), and Booz Allen Hamilton (BAH). These deep partnerships are driving the digital transformation of entire industries. Amazon’s AI business already has a multibillion-dollar annual run rate and is growing by the triple digits. This quarter also saw the launch of Alexa Plus, Amazon’s next-generation voice assistant. It is smarter, more action-oriented, and completely free for Prime members.

Beyond its core businesses, Amazon’s satellite broadband network, Project Kuiper, has launched its first satellites and expects to start service this year. If Kuiper is successful, it could launch a new multibillion-dollar business in connectivity, data services, and cloud extension. For long-term investors, this adds an additional layer to Amazon’s growth story. In entertainment, Amazon’s studio ambitions are taking a new turn with the James Bond franchise, which it will co-produce through a high-profile joint venture. Amazon spent $24.3 billion on capital expenditures in the first quarter, the majority of which went toward AWS infrastructure to support its rapidly expanding AI business. Notably, Amazon is aligning its capex with future megatrends such as cloud computing, AI, robotics, and connectivity.

Analysts who follow Amazon stock expect earnings to rise by 12.4% in 2025, followed by another 17.2% in 2026. While the stock is trading at a premium of 36 times forward earnings, its significant investments in multiple revenue engines position it for continued growth in the years ahead.

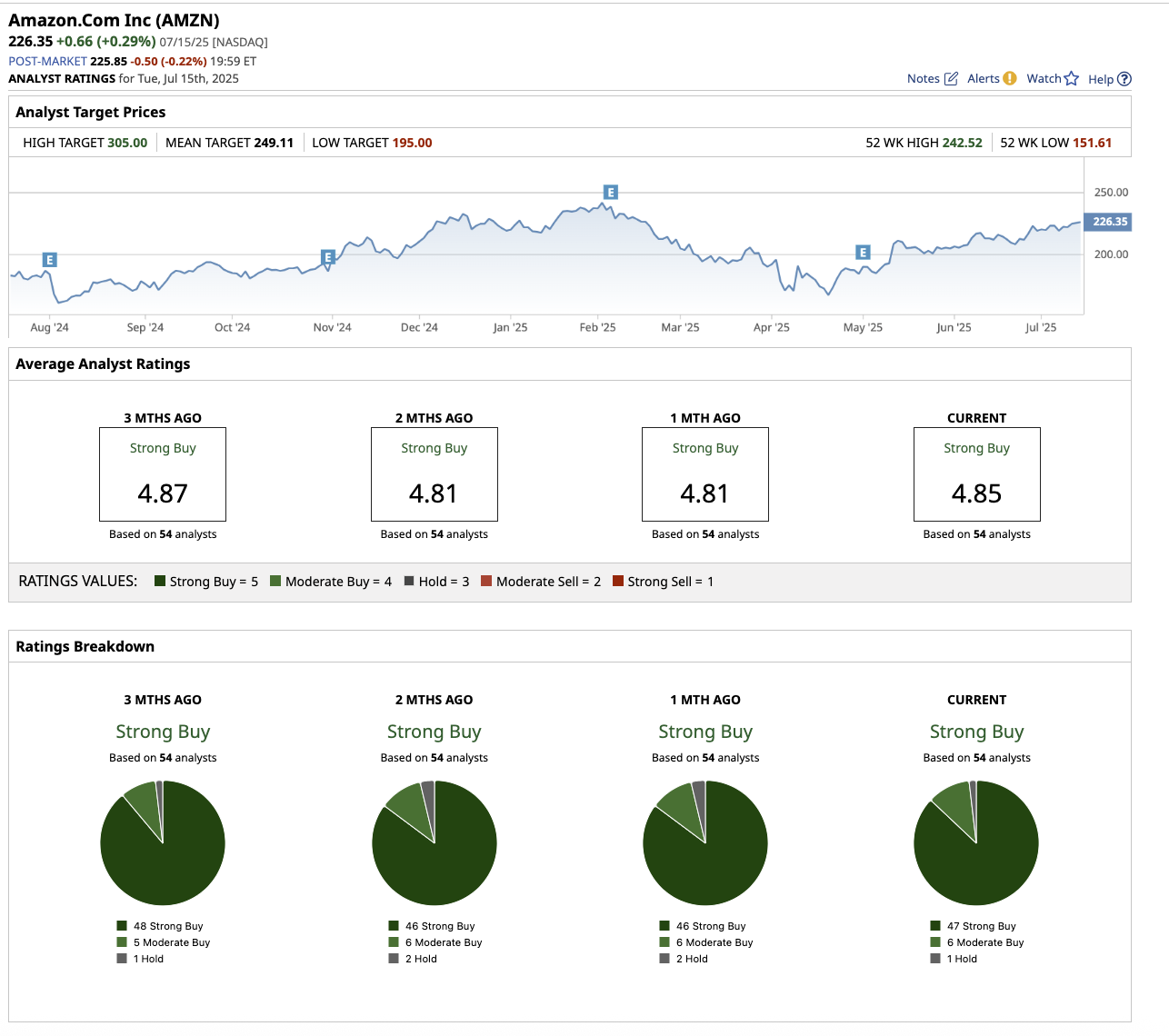

What Is Wall Street’s Take on AMZN Stock?

Overall, Amazon stock remains a “Strong Buy” in the analyst community. Of the 54 analysts covering the stock, 47 have given it a “Strong Buy” rating, six recommend a “Moderate Buy,” and one has a “Hold” rating. The average target price is $249.11, indicating potential upside of 10% from its current price. Additionally, the highest target price of $305 suggests the stock could rise by as much as 35% over the next 12 months.

The Key Takeaway

Amazon is more than just a retailer and a cloud provider. It is a vertically integrated, technology-driven ecosystem with multiple revenue streams, including e-commerce, cloud, advertising, logistics, AI, hardware, and more. In an increasingly volatile world, Amazon provides a unique blend of scale, growth, profitability, and long-term vision, making it one of the most compelling long-term growth stories in tech. However, since the stock is trading at a premium, risk-averse investors may want to wait for a more favorable entry point at around the $205 and $215 levels to invest with a margin of safety.

On the date of publication, Sushree Mohanty did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.